Portfolio Thinking: Connecting Investment, Work, and Value

Many organisations are busy but stalled. This essay explores why work and value drift apart — and how portfolio thinking restores clarity between investment, effort, and outcomes.

Editorial Note: This essay forms part of the Cultivated canon on Idea → Value.

It explores why organisations often feel busy yet stalled — and how portfolio thinking restores clarity between effort, investment, and outcomes.

This is not a guide to tools or governance. It is a way of seeing work.

Busy Work, Valuable Work, and the Missing View in Between

In many organisations — particularly medium and large ones — there are capable, thoughtful people doing work that consumes time, energy and attention but releases little value.

At the same time, there is work that is valuable, but sits disconnected from strategy.

It happens quietly.

Often without recognition.

Sometimes without protection.

Both situations are costly.

People are busy.

Money is spent.

Yet the organisation is no closer to where it intended to go.

This is not a motivation problem.

It is a visibility and connection problem.

The Invisible Gap Between Effort and Outcome

Most organisations invest money with an expectation of value.

They fund programmes.

They approve initiatives.

They allocate teams.

But somewhere between investment and value, the line of sight is lost.

Work fragments.

Context fades.

Activity becomes the proxy for progress.

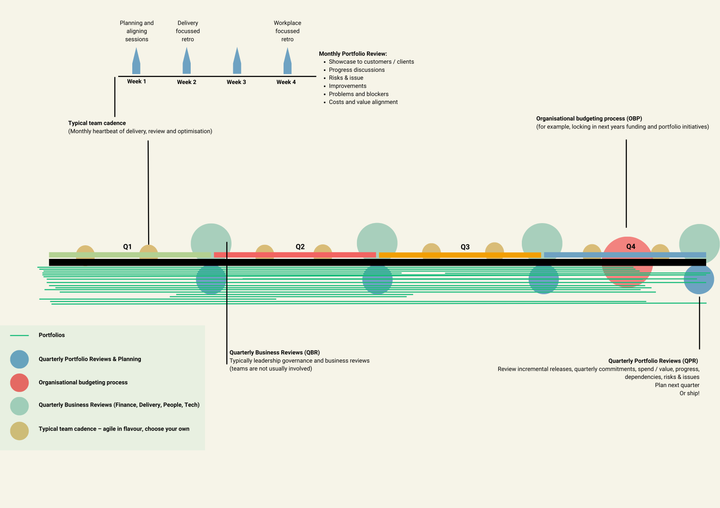

A portfolio view exists precisely to prevent this drift.

What Portfolio Thinking Really Is

A portfolio was once a simple thing.

A collection of papers carried together.

In organisations, a portfolio is the same idea applied to work:

a coherent view of everything we are investing in, and why.

Not to control people.

Not to micromanage delivery.

But to understand:

- where time, energy and attention is going

- how money is being used

- what value is expected in return

Without this view, leaders, managers and teams are left guessing.

Teams work hard in isolation.

And alignment is assumed rather than demonstrated.

Visibility Is Not Control

Portfolio management is often misunderstood.

It is mistaken for governance theatre.

For reporting overhead.

For interference.

For control.

In reality, its purpose is far simpler — and more humane.

It answers a small set of essential questions:

- What are we investing in?

- What work is happening because of that investment?

- What value is being released — or not?

When these connections are visible, trust improves.

When they are hidden, suspicion grows.

A Simple Structural Truth

Every piece of organisational work sits in a chain:

Investment → Activity → Value

Break that chain, and effort leaks away.

Strengthen it, and even imperfect work begins to compound.

The mistake many organisations make is adding layers of complexity where clarity would suffice.

In practice, most portfolios need only a few lenses:

- a funding view

- an initiative or outcome view

- a team view

Anything more should earn its place.

Investment Deserves Respect

Every project is a bet.

Sometimes the return is financial.

Sometimes it is capability, risk reduction, resilience, learning, cost reduction or trust.

But it is always something.

When leaders cannot clearly articulate:

- why the investment exists

- what problem it addresses

- how value will be recognised

the work that follows becomes performative.

Money is spent.

Learning is minimal.

And stopping becomes politically difficult.

Good portfolio thinking makes stopping responsible, not shameful.

Activity Is Not the Enemy

Teams need freedom to work.

Portfolio thinking does not remove autonomy — it gives it meaning.

When teams can see how their work connects upward:

- effort feels purposeful

- priorities make sense

- trade-offs become easier

Without that context, people default to busyness.

It is safer to stay occupied than to ask whether the work matters.

Value Is the Only Honest Measure

Some value arrives slowly.

Some arrives all at once.

Some never arrives at all.

A portfolio view allows organisations to notice the difference.

It enables better conversations:

- Should we continue?

- Should we change direction?

- Should we stop?

Without this feedback, organisations overspend quietly — sometimes for years.

Not because people are careless.

But because no one can see clearly enough to act.

Portfolio Thinking as a Leadership Practice

Portfolio management is not a silver bullet.

It does not replace strategy.

It does not substitute for judgment.

But it creates the conditions for better leadership.

It surfaces misalignment early.

It invites honest conversations about value.

And it treats organisational investment with the seriousness it deserves.

A useful test is a simple one:

Would you spend your own money this way, without visibility of return?

If not, why accept it at work?

Closing Reflection

When organisations feel busy but ineffective, the issue is rarely effort.

It is coherence.

Portfolio thinking restores a simple discipline:

connecting investment to activity, and activity to value.

When that chain is visible, people do better work.

When it is broken, even the best intentions drift.

Clarity, not control, is what turns work into value.

This piece forms part of Cultivated’s wider body of work on how ideas become valuable, and how better work is built.

To explore further:

→ Library — a curated collection of long-form essays

→ Ideas — developing thoughts and shorter writing

→ Learn — practical guides and tools from across the work

→ Work with us — thoughtful partnership for teams and organisations